cares act stimulus check tax implications

Recent changes to the CARES Act resulting from the COVID-19 pandemic will have state and local tax implications for your business. The Los Angeles County Community Connectory launched in April 2020 in response to the rapidly spreading COVID-19 pandemic and the economic crisis that it continues to cause.

Federal Aid In 2022 No More Stimulus Checks In Sight Child Tax Credit Payments Expired Abc7 New York

The tax implications of the CARES Act at the state level first depends on whether a state is a rolling Internal Revenue Code IRC conformity state or.

. Stimulus Payments and Child Tax Exemption The CARES Act will provide many individuals with a recovery rebate known as a stimulus payment or stimulus check in the next few weeks based upon. The CARES Act Stimulus is being offered to taxpayers for financial relief in light of COVID-19. Accounting for the stimulus.

Apply for an Employer ID Number EIN Get Economic Impact Payment Information. If your 2021 income is lower than the 2019 or 2020 income used to determine your eligibility earlier this year you can potentially claim additional stimulus money on your tax return. CARES Act Provides Tax Incentives for Charitable Giving in 2020.

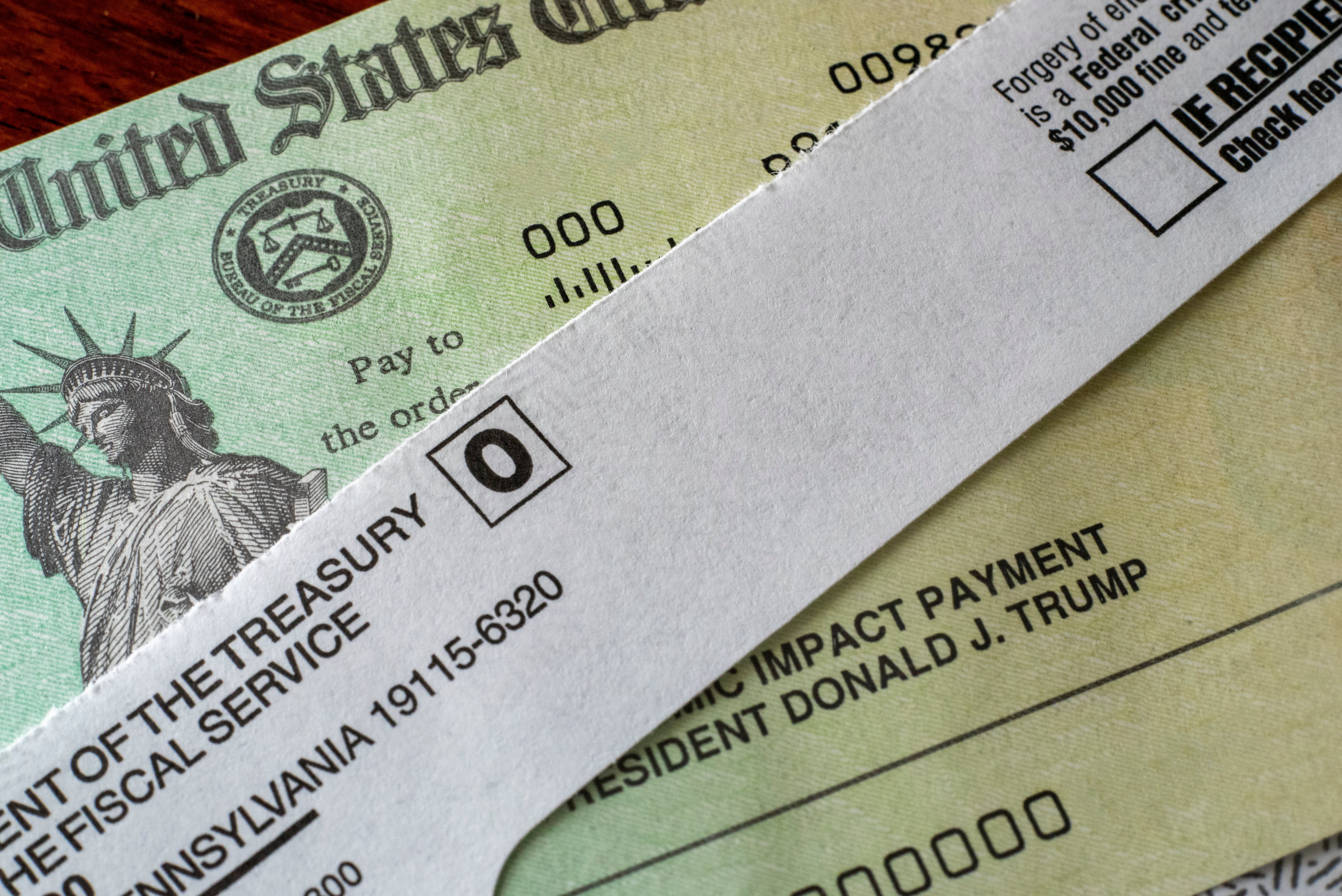

The payments will be 1200 per adult for those with adjusted gross incomes of up to 75000. Stimulus Check Information - CARES Act. The federal coronavirus aid relief and economic security act cares act consolidated appropriations act 2021 and american rescue plan act of 2021 contained a number of tax provisions that impact the computation of taxable income for individuals and businesses modify eligibility for certain tax credits and provide assistance to taxpayers.

Cares act stimulus check tax implications Saturday June 4 2022 With tax season entering the final stretch ahead of the Internal Revenue Services IRS May 17 deadline Americans who received stimulus checks worth up to 1200. An EIP2 payment 23 de jun. The Impact Of The Cares Act On Economic Welfare Bfi Senate on March 25 passed the CARES ActHR.

Sign in to Your Account. Electing employees may not claim a charitable deduction for the value of the donated leave. This challenging situation called for the immediate creation of a new aggressive outreach initiative to target and provide crucial resources for vulnerable small businesses.

Find Your Child Tax Credit Payment Information. Couples will receive 2400. If you have a qualifying child 16 and under each child will add an additional 500.

The Treasury Department and the Internal Revenue Service today announced that distribution of Economic. As a result to COVID-19 the Federal Government is taking action to ease the burden to taxpayers by passing the Coronavirus Aid Relief and Economic Security Act HR 748 also known as the CARES Act. Individual taxpayers will be receiving a 1200 payment.

Cares act stimulus check tax implications Friday March 18 2022 Edit. If you did not receive your coronavirus stimulus check despite being eligible for it. This article will help you understand what that means for your small business taxes.

Check out our Stimulus Check Calculator. Get Your Tax Record. So how much are people going to be receiving for the direct economic impact payments included in the CARES Act.

The CARES Act allows for a five-year carryback of Federal NOLs generated in tax years beginning in 2018 2019 or 2020 and removes the 80 taxable income limitation for NOL deductions for tax years beginning before January 1 2021 ie it allows an NOL to fully offset taxable income. Cares act stimulus check tax implications Tuesday July 12 2022 If your 2021 income is lower than the 2019 or 2020 income used to determine your eligibility earlier this year you can potentially claim additional stimulus money on your tax return. File Your Taxes for Free.

The payments will not impact your tax owed for 2020 and will not reduce your possible refund. The amount of the stimulus check will be reduced or phased out for individuals whose income is between 75000 and 99000 with no checks issued for those making above the 99000 threshold. Yes the value of leave donated in exchange for amounts paid before January 1 2021 to organizations that aid victims of COVID-19 is excludable from an employees income for California income tax purposes.

When the CARES ACT passed taxpayers were informed they would be receiving a stimulus payment of up to 1200 for single filers 2400 for joint filers plus an additional payment for those who had dependent children. Where S My Third Stimulus Check Turbotax Tax Tips Videos.

The Effect Of Stimulus And Increased Unemployment Payments On The Economy In 2022 Gobankingrates

/singleparentstimuluscheck-2000-ab18de6ce96e47eca24175b480e92e71.jpg)

For Single Parents The Stimulus Payment May Cause Confusion Here S What You Need To Know

Will You Have To Pay Back Stimulus Money At Tax Time Findlaw

These 7 States And Cities Are Offering Additional Stimulus And Financial Aid Forbes Advisor

Stimulus Check 2021 Irs Says Letter From White House Outlining Stimulus Payments Not A Scam 6abc Philadelphia

Irs Parents Of Children Born In 2021 Can Claim Stimulus As Tax Credit Ktla

Biden Signs Third Stimulus Package Into Law 1 400 Stimulus Checks Expanded Unemployment Benefits And Much More Forbes Advisor

Are Second 1 200 Stimulus Checks Coming Here S What We Know

How Will The 3rd Covid 19 Stimulus Payment Affect My 2021 Tax Return The Official Blog Of Taxslayer

Recovery Rebate Credit H R Block

18 Billionaires Reportedly Received Covid Stimulus Checks

Stimulus Checks For Us Expats Everything You Need To Know

Who Qualifies For A 1 400 Stimulus Payment Under The House Bill

Second Stimulus Checks What Nonresidents Need To Know

/stimulus_checks_jeff_fusco-56a9aaa25f9b58b7d0fdcc5d.jpg)

The Quickest Way To Get Your Next Stimulus Check

Are Second 1 200 Stimulus Checks Coming Here S What We Know

How Many Stimulus Checks Were Issued In 2020 And How Many People Received Them As Usa

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/cloudfront-us-east-1.images.arcpublishing.com/gmg/SUXOOLZOWJFIBCXTEHSTHTVZZU.jpg)